The Leading Attributes to Seek in a Secured Credit Card Singapore

The Leading Attributes to Seek in a Secured Credit Card Singapore

Blog Article

Revealing the Possibility: Can People Released From Insolvency Acquire Debt Cards?

Recognizing the Influence of Insolvency

Bankruptcy can have a profound effect on one's credit scores rating, making it challenging to gain access to debt or financings in the future. This monetary tarnish can linger on credit reports for numerous years, impacting the person's ability to safeguard beneficial interest rates or economic possibilities.

Moreover, bankruptcy can limit employment possibility, as some employers conduct credit score checks as component of the hiring process. This can present an obstacle to people seeking brand-new task prospects or profession advancements. In general, the effect of insolvency prolongs beyond financial restraints, affecting various facets of a person's life.

Elements Impacting Charge Card Approval

Getting a debt card post-bankruptcy rests upon numerous vital aspects that substantially affect the authorization process. One important aspect is the applicant's credit history. Following bankruptcy, individuals often have a reduced credit rating due to the negative influence of the insolvency filing. Bank card business usually search for a credit history that demonstrates the candidate's capacity to take care of credit rating properly. An additional important consideration is the candidate's income. A steady revenue guarantees credit scores card companies of the person's capacity to make timely payments. In addition, the length of time considering that the insolvency discharge plays an important role. The longer the period post-discharge, the a lot more beneficial the opportunities of approval, as it suggests monetary stability and liable credit actions post-bankruptcy. Furthermore, the sort of bank card being gotten and the provider's particular demands can additionally affect approval. By carefully taking into consideration these variables and taking actions to reconstruct credit post-bankruptcy, individuals can boost their prospects of acquiring a charge card and functioning in the direction of monetary recovery.

Actions to Rebuild Debt After Personal Bankruptcy

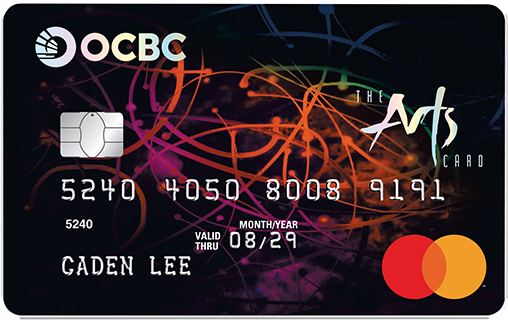

Restoring credit score after insolvency needs a calculated method concentrated on monetary discipline and regular financial obligation administration. The initial step is to evaluate your credit scores report to make sure all financial obligations included in the bankruptcy are properly shown. It is vital to establish a budget plan that focuses on financial debt payment and living within your ways. One efficient technique is to get a secured credit rating card, where you deposit a specific amount as collateral to establish a debt limit. Timely repayments on this card can show liable credit rating usage to prospective loan providers. Furthermore, think about becoming an accredited customer on a relative's charge card or exploring credit-builder financings to further improve your credit report. It is crucial to make all repayments promptly, as settlement history considerably affects your debt score. Patience and determination are crucial as reconstructing credit takes time, however with commitment to appear economic techniques, it is possible to enhance your credit reliability post-bankruptcy.

Safe Vs. Unsecured Credit Report Cards

Complying with bankruptcy, people often think about the choice in between secured and unsafe credit score cards as they aim to restore their creditworthiness and financial security. Secured charge navigate here card require a cash money deposit that works as security, usually equivalent to the credit line approved. These cards are less complicated to acquire post-bankruptcy given that the deposit reduces the threat for the company. Nevertheless, they might have greater charges and rate of interest prices compared to unsecured cards. On the various other hand, unsafe charge card do not require a deposit but are harder to receive after personal bankruptcy. Providers analyze the applicant's creditworthiness and might use lower charges and rate of interest for those with a great economic standing. When determining in between both, people need to evaluate the advantages of simpler authorization with safe cards against the prospective prices, and think about unsafe cards for their long-term economic goals, as they can help restore debt without locking up funds in a deposit. Inevitably, the selection between secured and unprotected bank card ought to straighten with the person's monetary purposes and ability to handle credit score sensibly.

Resources for Individuals Looking For Credit Rating Rebuilding

For individuals intending to enhance their credit reliability post-bankruptcy, exploring offered sources is critical to effectively browsing the credit scores rebuilding process. secured credit card singapore. One useful source for people seeking credit report rebuilding is credit scores counseling companies. These companies offer economic education, budgeting assistance, and personalized credit rating renovation strategies. By collaborating with a credit scores counselor, people can gain insights into their credit score records, discover approaches to boost their credit report, and get support on handling their financial resources successfully.

An additional useful source is debt monitoring services. These services enable people to maintain a close eye on their credit records, track any type of read what he said errors or adjustments, and find possible indicators of identification burglary. By checking their credit routinely, people can proactively address any type of issues that might make sure and arise that their credit history information depends on date and accurate.

In addition, online tools and sources such as credit report simulators, budgeting applications, and monetary proficiency sites can give individuals with beneficial info and devices to assist them in their credit report rebuilding trip. secured credit card singapore. By leveraging these resources properly, people released from bankruptcy can take significant actions in the direction of enhancing their credit rating health and protecting a far better financial future

Final Thought

Finally, individuals released from personal bankruptcy might have the opportunity to acquire charge card by taking actions to restore their debt. Elements such as debt debt-to-income, history, and income ratio play a significant role in charge card approval. By understanding the impact of bankruptcy, choosing between secured and unsecured charge card, and utilizing sources for credit scores rebuilding, people can enhance their creditworthiness and possibly get accessibility to credit history cards.

By functioning with a credit score therapist, individuals can gain understandings right into their debt records, discover strategies to more info here boost their credit ratings, and get guidance on handling their finances successfully. - secured credit card singapore

Report this page